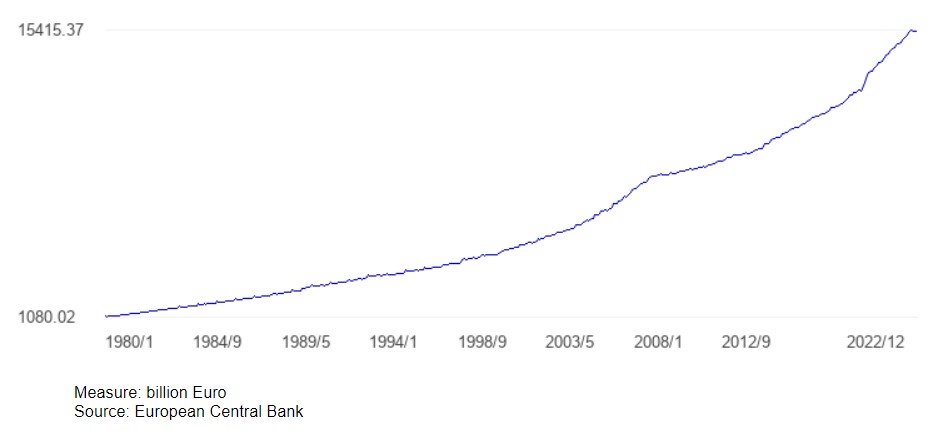

The 20th century saw government currencies abandon the gold standard, instead pegging themselves to the gold-backed US Dollar until 1971, when the United States followed suit and put the final nail in the gold standard coffin. Since then, the amount of a currency in circulation has become arbitrary, determined by central bank policies which have since allowed an exponential increase in money printing and resulted in high levels of inflation.

How can you save your earnings and plan for the future in a world where central banks can print infinite amounts of money, devaluing your savings at no cost to themselves? In this article we’ll evaluate how government currencies perform over time, and explore how using Bitcoin as a savings technology could help you escape fiat inflation.

Saving in Fiat

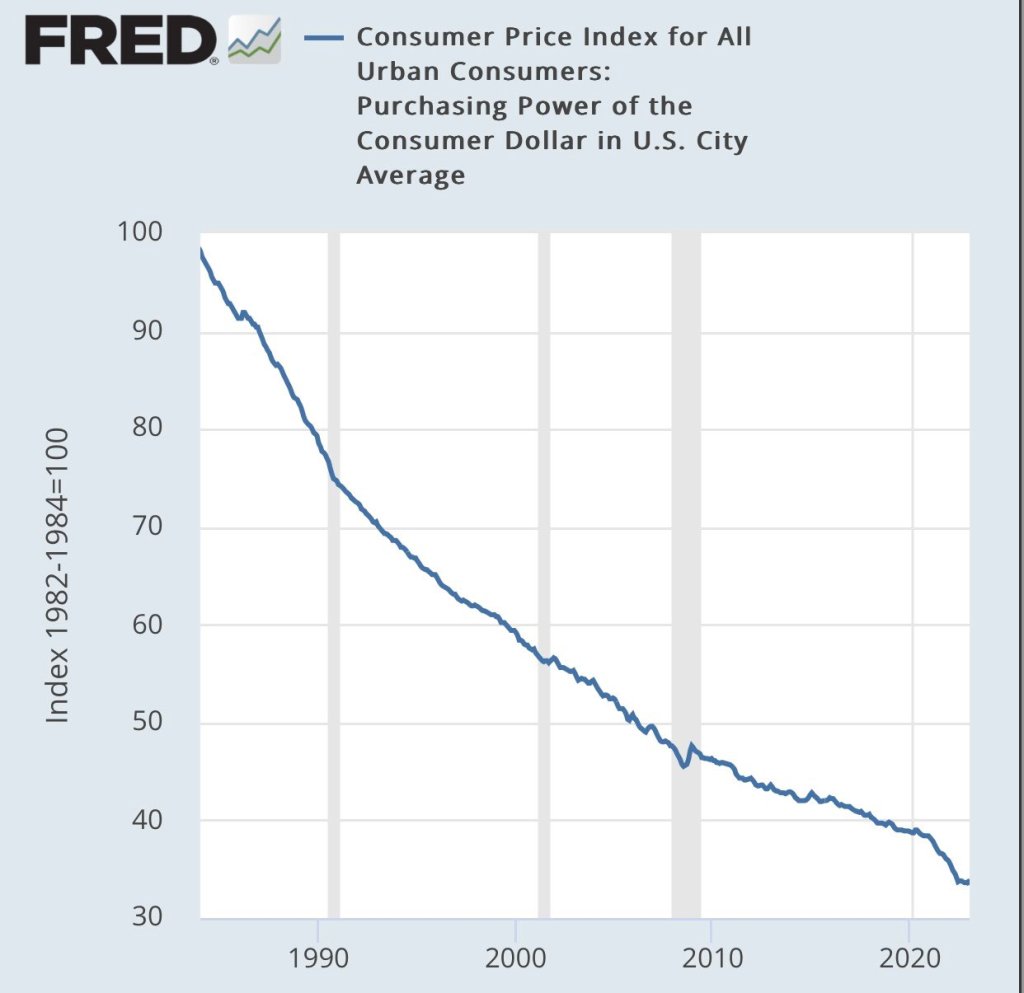

Alex Gladstein of the Human Rights Foundation pointed out in 2021 that 1.2 billion people across the world are experiencing double or triple-digit inflation. People living in countries such as Nigeria, Lebanon and Venezuela, for example, have experienced the hardship and social unrest that high levels of inflation brings to a country. Though it is a global issue, many in the West assume that they are immune to the effects of inflation, believing their first-world fiat currencies to be an adequate vehicle for their savings, at least until recently. Let’s have a look at the performance of the US dollar, the Euro and the British Pound:

These charts are presenting the official inflation data, however people find that their purchasing power is declining much more sharply than this official rate. The purchasing power of a currency is measured by indexes such as the Consumer Price Index (CPI), which are concocted by central banks and governments and based on the price of a ‘basket’ of goods and services. The products included in the baskets are routinely substituted for cheaper goods or smaller portions, a tactic used to make the inflation rate seem lower than it actually is: over time, a ribeye steak becomes a burger, 100g of chocolate becomes 80g. Despite efforts to reduce the official inflation rate by the manipulation of the CPI basket, the purchasing power of the currency still continues to fall rapidly.

Even the best fiat currencies appear to be competing in a race to zero. No matter the timeframe, their value always goes down, and this trend has been accelerating as a result of the record amount of money printed by all central banks this past decade.

In the current fiat monetary system, governments can use money newly created by the central bank to fund their spending. This process allows them to spend more than they collect in taxes, however this process of money creation and debt ultimately siphons the value out of the currency, and leaves savers with less and less purchasing power each year. Indeed, more money chasing the same goods means higher prices.

Saving in Bitcoin

Bitcoin was launched in 2009. It is a decentralized monetary network run by open-source code which allows anyone in the world with an internet connection to store and transfer value. The Bitcoin network has its own native currency called bitcoin (BTC). Unlike fiat currencies, the maximum supply of Bitcoin is fixed: there can never be more than 21 million bitcoin. The quantity of bitcoin cannot be increased to accommodate new users which means that when there is more demand for it, the price of BTC must go up.

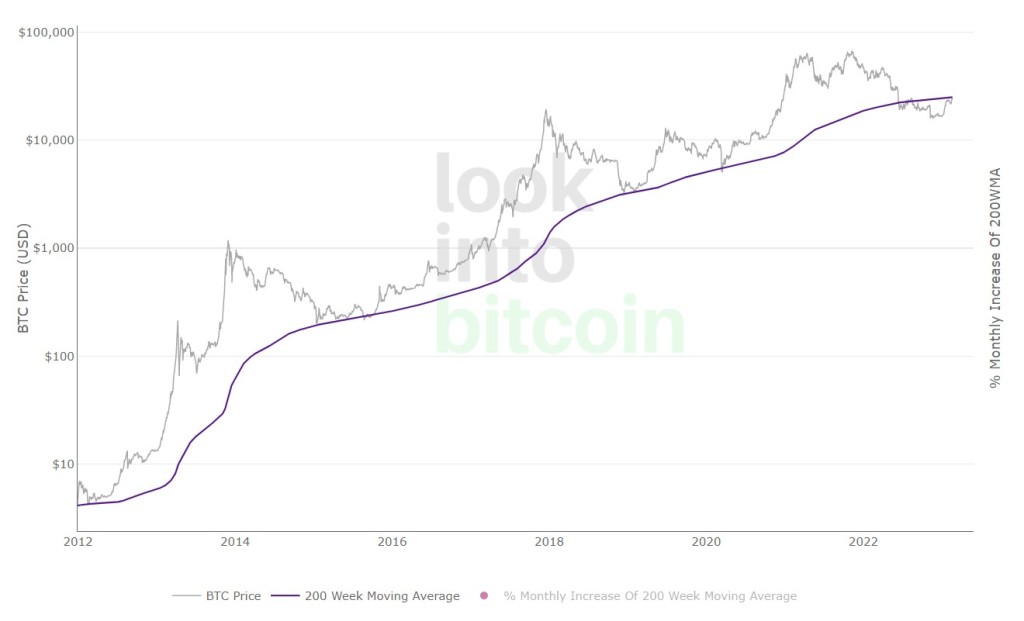

Over the years Bitcoin has been dismissed and ridiculed and many have used the opportunity of a price crash to declare the project dead. A simple look at this price chart is enough to know that you would have been vastly better off holding bitcoin over this period rather than a fiat currency, or any other asset for that matter.

As more and more people have realized its unique monetary properties, BTC has come from being a peculiar internet collectible to become one of the biggest currencies in the world in terms of total value and number of users. The spectacular price increases of Bitcoin often attract people looking for a get-rich-quick scheme, however trading bitcoin in an attempt to profit from market fluctuations is a game most people will lose. Bitcoin’s volatility decreases as the number of users and the liquidity increases, but even today holders must be comfortable experiencing occasional price drawdowns of 50% or more. This means Bitcoin is best used as a tool for long-term saving.

The optimal strategy for saving in Bitcoin turns out to be the easiest one: buying a fixed amount of bitcoin periodically, regardless of the price at that time. Determining what proportion of your earnings you should allocate to Bitcoin is a decision unique to you and your financial situation, your goals and your time horizon.

Please remember that using Bitcoin requires personal responsibility: your money is in your own hands and no one can retrieve lost bitcoin. Back-ups of your Bitcoin wallet must be adequately created and secured.

Do your own research

This article is my personal opinion and does not constitute financial advice. Sources for the data are provided through the article. You should conduct your own due diligence before investing.

Posted at block 777720

Leave a comment