Today marks the 14th anniversary since the launch of the Bitcoin network. Now come to be known as the Genesis block, it refers to the first block ever mined on the Bitcoin network by anonymous computer scientist Satoshi Nakamoto on 3rd January 2009.

14 years after its inception, the Bitcoin network has lived up to its promises. Since 2009 and for the first time in human history, we have a digital online cash system that permits peer-to-peer money transfers over a communications network, and an internet native asset that no central authority can create for free.

The First Block

Satoshi most likely generated the hash for the genesis block using an ordinary computer’s CPU. The network’s difficulty stayed constant for almost a year, with new blocks coming in a little more than 10 minutes apart on average. It was only at the end of December 2009 at block 32,256 that the difficulty increased for the first time as new participants joined the network and started competing for the block reward, which was 50 BTC at the time.

During the network’s infancy, most blocks were empty, except for the coinbase transaction which awards the successful miner with the block reward. The first transaction on the Bitcoin network happened in block 170 on 12th January 2009, when Satoshi transferred the ownership of 10 BTC to Hal Finney.

Satoshi, who was communicating via email and through the bitcointalk.org forum, disappeared after his last post on December 12th 2010. It is estimated that he mined a little over one million BTC to support the nascent Bitcoin network. None of the bitcoin associated with his addresses has ever moved and it is now considered lost for all intents and purposes, further reducing the total available supply.

Bitcoin today

The Bitcoin network has been growing since 2009 and seems to be following an adoption curve similar to other technologies such as the internet and mobile phones.

The hashrate has been increasing exponentially since the first difficulty adjustment as individuals, followed by multi-million dollars public companies, started their scramble for digital gold. Today, it takes about 35 trillion times the number of hashes it took Satoshi in 2009 to find a valid block hash in 10 minutes.

Bitcoin, which started changing hands for a price of 0.0008 USD per bitcoin in July 2010, has been known for a series of hype cycles that has carried its price to thousands of dollars per bitcoin in 2023. These spectacular price increases, along with an improved collective understanding of Bitcoin and the development of better tools that make it easier and safer to use, bring an ever-increasing number of users to the network. Bitcoin today is a currency, a payments network, a savings vehicle, a community and a way of life for millions of people over the world.

Bailout for banks

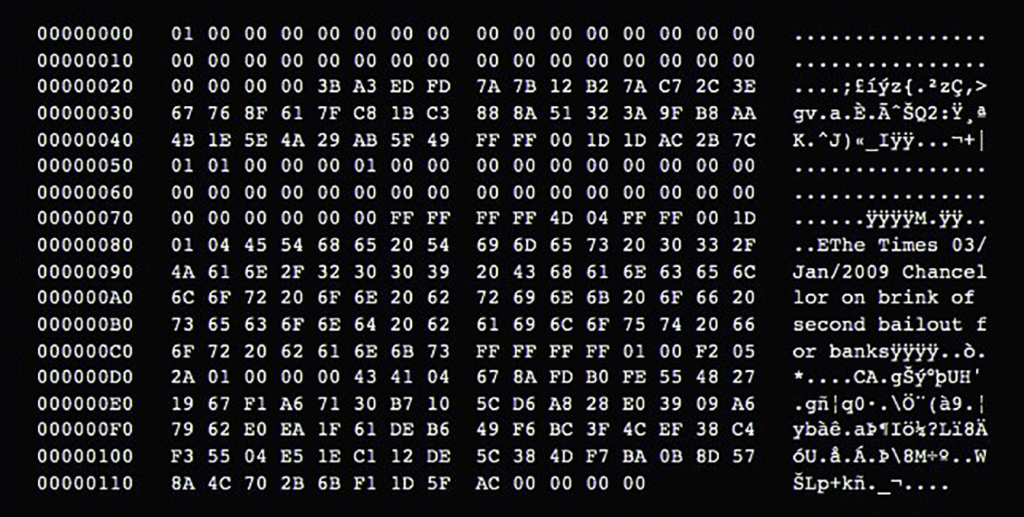

Satoshi Nakamoto left a message within the genesis block’s raw data. It reads “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks”, referring to the British newspaper’s headline from that day:

The 2008 financial crisis and the resulting bailouts were a symbol of the fiat financial system growing increasingly unstable, arbitrary and unfair. Echoing these bailouts mentioned by Satoshi 14 years ago, the Bank of England recently had to step in again and rescue failing UK pension funds.

Today, the need for a non-discretionary monetary system is more obvious than ever. Since the start of Quantitative Easing by the US Federal Reserve in 2008, the equivalent of 25 trillion USD has been injected into the economy by major central banks caught between a rock and a hard place: they must try to tame inflation, but the only way to keep a debt based system afloat is to print ever increasing amounts of currency.

Bitcoin can provide everyone on Earth with an alternative, non-political financial system. The inflexibility of Bitcoin’s rules and the resulting inability to ‘print’ money at no cost makes for a fair system where all participants are on equal footing.

Predictable and immutable money

“The nature of Bitcoin is such that once version 0.1 was released, the core design was set in stone for the rest of its lifetime.”

Satoshi Nakamoto

Through the highs and the lows of the relatively young network, the biggest takeaway may be that Bitcoin has proven itself to be decentralised and controlled by its users. Despite attempts at changing its parameters, whether by its miners or other powerful and influential actors, Bitcoin still enforces the same consensus rules as 14 years ago. Nodes that breach this consensus will simply create a “hard fork” of the network and will be unable to interact with the valid chain.

Because it is immune to opinions and political pressures, Bitcoin’s monetary policy is unfolding as planned: the issuance of bitcoin is cut in half every 210,000 blocks, an event commonly referred to as the ‘halving’ which occurs approximately every 4 years. The next halving will occur in early 2024 at block 840,000 when the block subsidy with be reduced from 6.25 BTC to 3.125 BTC. Unlike any other asset or currency, Bitcoin’s supply is known, predictable, and verifiable.

Posted at block 770196

Leave a comment